SigFig

Founded in 2006, SigFig is a fintech company whose industry-leading robo-advisor brings investment products to 1 in 3 households in North America. It’s white-labeled to financial institutions of all sizes, from small and local credit unions, to national banks with thousands of branches. As a result of rapid iteration and growth, the products were functionally and visually disconnected. By the time I was there, it was time for greater product maturity as the company entered its most recent phase of growth.

As principal designer, my focus was on identifying new product areas to build revenue, and improving the overall Digital Wealth experience, SigFig’s core investment platform. I partnered with cross-functional leaders to develop strategies around these efforts to land them on the roadmap. At the same time, I contributed to iterative hands-on work that was being shipped regularly, designed user flows & journeys, and visual concepts for our revenue-building opportunities, and led design for our overall product strategy.

When I joined SigFig, I was asked to take a holistic look at the product ecosystem and identify gaps and opportunities, both in the experience and in the business. I worked collaboratively and cross-functionally to learn perspectives, observations, pain-points, goals, etc.

From here I laid out two primary goals:

• Increase revenue from existing products (Digital Wealth)

• Develop innovative new products to acquire new customers and retain existing customers (SigFig Path)

Click into the projects below to dig into both of these, as well as other areas of my work.

A configurable ecosystem of pre-built widgets and modules, transforming everything from pricing models, to sales pitches, to partner implementations.

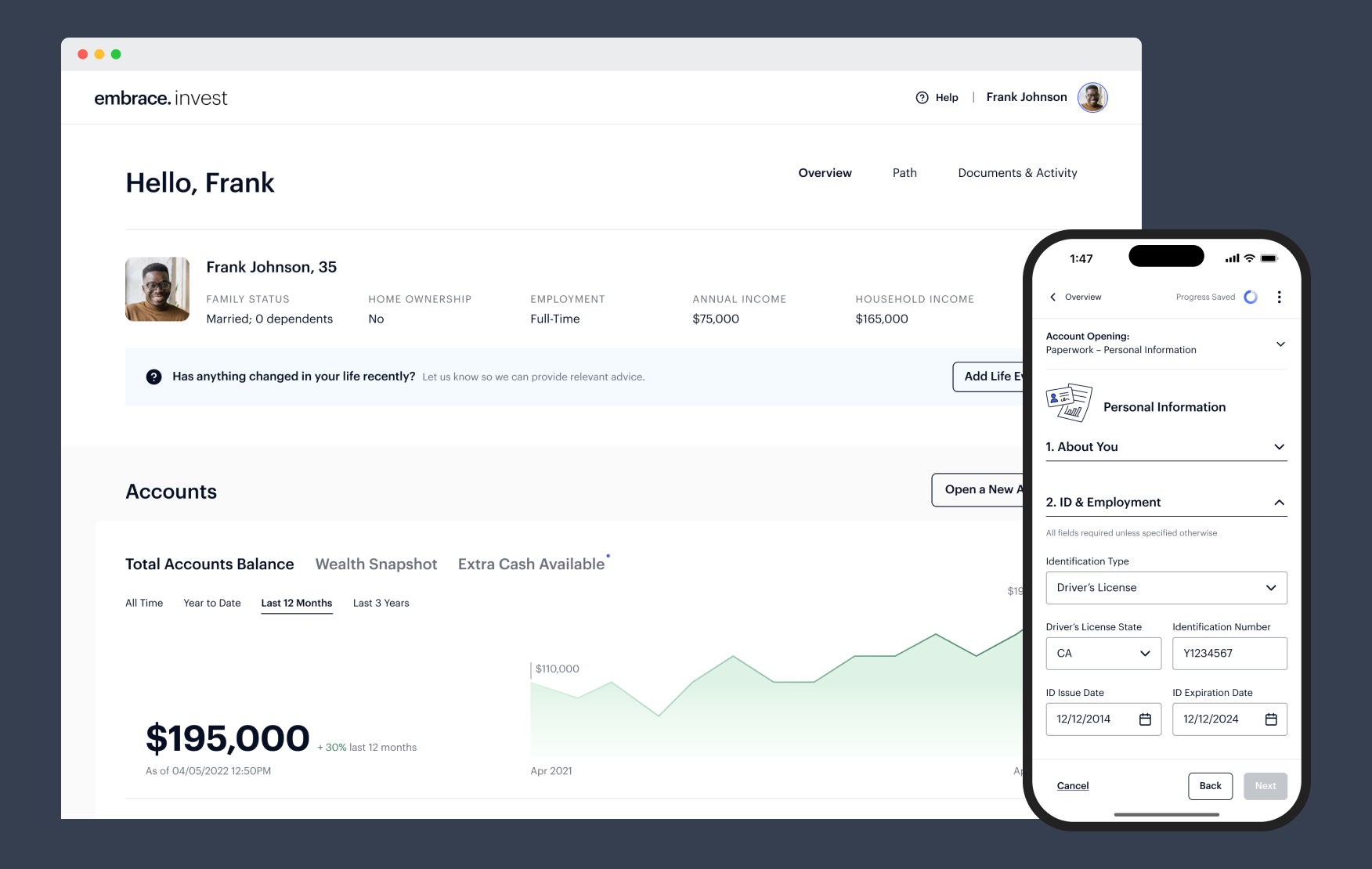

The redesign of our onboarding flow into a native mobile experience, helping customers open new investment accounts more easily, without impacting risk.

A collection of some of the visual explorations I personally designed, and oversaw, as part of our digital transformation efforts.

A 0-1 product expanding customer access by bringing inclusive and personalized goal setting and financial planning to those chronically ignored and financially excluded from traditional banking and investment institutions.